529 Plans: The Smart Way to Save for Education-And More

07/02/2025

If you’re thinking about how to pay for your child’s education—or even your own—there’s one tool that’s worth a closer look: the 529 savings plan.

What Is a 529 Plan?

A 529 plan is an investment account that grows tax-deferred, and when the money is used for qualified education expenses for K-12 schooling and college. Qualified withdrawals are tax-free at the federal and Iowa level along with the investment earnings are tax-free. Iowa sponsors its own 529 plan called ISave 529 offered by the Iowa Educational Savings Plan Trust. For Iowa taxpayers, a 529 account owner can deduct up to $5,800 of your contributions per beneficiary account, including rollovers, from your Iowa income taxes in 2025.

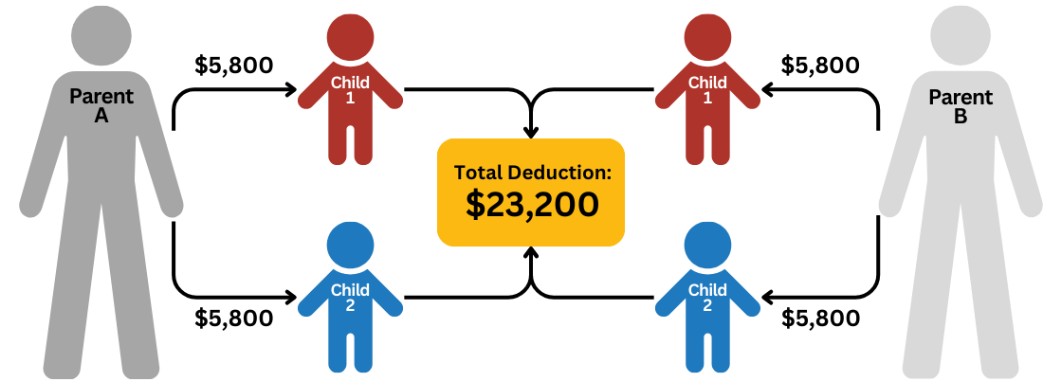

Below is an example of a scenario in which two married account owners contribute to separate accounts on behalf of their two children. For 2025 married filing jointly, they may deduct up to $23,200 (4 x $5,800).

Who Can Contribute to It?

To be eligible to open one, you need to be a U.S. citizen, at least 18 years old, have a Social Security number or taxpayer ID, and have a valid U.S. street address (PO Box addresses not accepted). Then, you choose how to invest the money. ISave 529 offers sixteen different investment options.

The beneficiary must also be a U.S. citizen with a Social Security number or other taxpayer information number. You can change the beneficiary or transfer a portion of the account to a different beneficiary without adverse tax consequences, provided the new beneficiary is a member of the family.

Parents don’t have to be the only ones to open or fund a 529 account. Grandparents, aunts, uncles, friends—even neighbors—can all open or contribute to an account. You don’t need to be related to the beneficiary, and you can even name yourself as the student on the account if you’re saving for your own education.

A 529 Plan Has Minimal Impact on Financial Aid

One common worry is that saving in a 529 plan will hurt your child’s chances of receiving financial aid. Fortunately, that impact is small. If a parent owns the 529 account, only up to 5.6% of the account value is counted in federal financial aid calculations. By comparison, student-owned assets can be assessed at up to 20%.

You Don’t Lose the Money If Your Child Doesn’t Go to College

What happens if your child receives a scholarship—or decides not to attend college at all? Good news: the money in your 529 plan isn’t lost. You can use it for other qualified family members (siblings, nieces, nephews, even yourself), or continue using it for other forms of post-secondary education. There’s even an option to roll unused funds into a Roth IRA under specific conditions, giving families more flexibility than ever.

Funds Aren’t Just for College—They Can Be Used for K–12 Tuition, Too

Another surprising perk: up to $10,000 per year from a 529 plan can be used for private elementary, middle, or high school tuition. At the college level, the funds go even further, covering not just tuition and fees but also room and board, books, supplies, computers, and internet access.

Small Contributions Can Still Make a Big Difference

Don’t underestimate the power of small, consistent savings. Thanks to compounding, even modest monthly contributions can grow significantly over time. Consider asking family and friends to contribute to your child’s 529 instead of buying toys or clothes during birthdays and holidays—those extra dollars can go a long way.

Recap

A 529 plan isn’t just for college—it’s a flexible, powerful savings tool that more families are using to plan ahead. Whether you’re saving for next year’s private school tuition or building a nest egg for college in 10 years, a 529 plan can help you get there with tax advantages and peace of mind.

Still have questions? Focus Investment Services offers a free consultation with Keri Blake ([email protected]) to help you review your financial health and plan for a stronger financial future.